In a previous post, I introduced the logic for the Linear Time Iteration (LTI) method (Pontus Rendahl (2017)). Now it’s time to apply the technique to a “real” (yet simple) economic model: a stochastic growth model with endogenous labor supply. The implementation is in Julia and is based a Matlab code by Pontus Rendahl available here. We will use a three-step approach:

- [1] solve the non-stochastic steady-state of the model

- [2] differentiate the system around the non-stochastic steady-state to obtain a linear difference equation of the form $A x_{t-1} + B x_{t} + C E_{t} [x_{t+1}] + u_{t} = 0$

- [3] apply the LTI method to find the law of motion $x_{t} = F x_{t-1} + Q u_{t}$

Model

We consider an economy populated by a representative household, deciding how much to work, save and consume at any given time. Output $y$ depends on the capital level $k$ (inherited from period $t-1$), on the number of hours worked $l$, and on the productivity level $z$:

$$ y_t = z_t k_{t-1}^{\alpha} l_{t}^{1 - \alpha}$$

Business cycles are driven by variations in productivity, that follows an AR(1) process, with $e_t$ a zero-mean stochastic variable:

$$z_t = \rho z_{t-1} + e_{t} $$

Capital at the end of period $t$ is equal to investment plus the non-depreciated capital stock inherited from last period:

$$ k_{t} = I_{t} + (1 - \delta) k_{t-1} $$

The representative household enjoys consumption and dislikes providing labor:

$$ U(c,l) = \frac{C^{1-\sigma}}{1-\sigma} - \frac{l^{1-\eta}}{1-\eta} $$

Everything that is produced in the economy is either consumed or saved:

$$ c_{t} + k_{t} = z_t k_{t-1}^{\alpha} l_{t}^{1 - \alpha} + (1 - \delta)k_{t-1}$$

The optimal decision of the household is characterized by two equations:

$$ c_{t}^{-\sigma} = \beta E_{t}(c_{t+1}^{-\sigma}(1 - \delta + \alpha z_{t+1} k_{t}^{\alpha -1} l_{t+1}^{1 - \alpha} ) )$$

$$ l_{t}^{-\eta} = c_{t}^{-\gamma}(1 - \alpha) z_{t} k_{t-1}^\alpha l_{t}^{-\alpha} $$

The first one states the gain of raising consumption today by one unit has to be equal to the expected gain from saving one extra unit today and consuming it tomorrow (inter-temporal FOC). The second equation states that the marginal cost of working one extra hour today has to be equal to the marginal gain of that extra hour worked (intra-temporal FOC).

Solving the steady-state

Calculating the steady-state of the model is a root finding problem. Let’s use the package NLsolve:

versioninfo()

Julia Version 1.0.3

Commit 099e826241 (2018-12-18 01:34 UTC)

Platform Info:

OS: Linux (x86_64-pc-linux-gnu)

CPU: Intel(R) Core(TM) i7-8850H CPU @ 2.60GHz

WORD_SIZE: 64

LIBM: libopenlibm

LLVM: libLLVM-6.0.0 (ORCJIT, skylake)

# Declare parameters

const alpha = 1/3; # Capital share of output

const beta = 1.03^(-1/4); # Discount factor.

const gamma = 2; # Coefficient of risk aversion

const eta = 2; # Frisch elasticity of labor supply

const delta = 0.025; # Depreciation rate of capital

const rho = 0.9; # Persistence of TFP process.

using NLsolve

# Let's define a function for each equation of the model at the steady-state

function Ee(x::Array{Float64,1})

-x[1]^(-gamma) + beta*(1.0 + alpha*(x[2]^(alpha - 1.0))*(x[3]^(1.0 - alpha)) - delta)*(x[1]^(-gamma))

end

function Rc(x::Array{Float64,1})

-x[1] - x[2] + (x[2]^(alpha))*(x[3]^(1.0 - alpha)) + (1.0 - delta)*x[2]

end

function Ls(x::Array{Float64,1})

(-x[1]^(-gamma))*(1.0 - alpha)*(x[2]^(alpha))*(x[3]^(-alpha)) + x[3]^(eta)

end

# The steady-state of the model is described by a system of three equations

f! = function (dx,x)

dx[1] = Ee(x)

dx[2] = Rc(x)

dx[3] = Ls(x)

end

res = nlsolve(f!,[1.0; 20; 0.7])

xss = res.zero;

css = xss[1];

kss = xss[2];

lss = xss[3];

# steady-state output and investment:

yss = kss^(alpha)*lss^(1-alpha);

Iss = kss-(1-delta)*kss;

XSS = zeros(6)

XSS[1]=yss

XSS[2]=Iss

XSS[3:5] = xss

XSS[6]=1.0;

print("Steady-state value [css, kss, lss, yss, Iss, zss] = ", XSS)

Steady-state value [css, kss, lss, yss, Iss, zss] = [2.51213, 0.645783, 1.86634, 25.8313, 0.78341, 1.0]

Solving the stochastic model

To find a solution to the stochastic model, let’s differentiate the system around the non-stochastic steady-state calculated above. Here, we will limit ourself to a first-order approximation since the goal is to obtain is a linear difference equation of the form $ A x_{t-1} + B x_{t} + C E_{t} [x_{t+1}] + u_{t} = 0 $, for which LTI is applicable. What is the rationale for the linear approximation? Fist of all, notice that the model can be put in the form of:

$$E_t(f(Y_t, \sigma)) = 0 $$

where $Y_t = [x_{t-1}, x_{t}, x_{t+1}]$ is $3n × 1$ vector containing endogenous and exogenous variables and $\sigma$ is variable scaling the level of uncertainty in the model. For instance, if $v_{t}$ is a zero-mean normally distributed variable with variance $\sigma^2$:

$$z_t = \rho z_{t-1} + \sigma v_{t} $$

In the non-stochastic state, $\sigma = 0$. Let’s take a first-order Taylor expansion around the non-stochastic steady-state:

$$f(Y_t, \sigma) \approx f(Y_{SS}, 0) + \frac{Df}{DY_t}|Y_{SS}(Y_t - Y_{SS}) + \frac{Df}{D\sigma}|\sigma_{SS}(\sigma - 0) = 0$$

where $\frac{Df}{DY_t}|Y_{SS}$ is the derivative of the vector-valued function $f$ with respect to the vector $Y_t$ evaluated at $Y_{SS}$

Using $f(Y_{SS}, 0) = 0$ and that the last term disappears when we take the expectation:

$$E_t(f(Y_t, \sigma)) \approx E_t(\frac{Df}{DY_t}|Y_{SS}(Y_t - Y_{SS})) = 0 $$

Defining the matrices $A$, $B$ and $C$ such that $\frac{Df}{DY_t}|Y_{SS} = [A; B; C]$ we obtain a system of the form:

$A \tilde{x}_{t-1} + B \tilde{x}_{t} + C E_{t} [\tilde{x}_{t+1}] = 0$

with $\tilde{x}_{t} = x_{t} - x_{SS} $

In practical terms, obtaining a linear approximation around the non-stochastic

steady-state is easily done using the package ForwardDiff

using ForwardDiff

# Function defining the stochastic model

# Each line is an equation

# The input the vector x is [ym y yp Im I Ip cm c cp km k kp lm l lp zm z zp]

f! = (w, x) -> begin

#naming the input variables:

ym, y, yp, Im, I, Ip, cm, c, cp, km, k, kp, lm, l, lp, zm, z, zp = x

w[1] = -y + z*km^(alpha)*l^(1.0 - alpha)

w[2] = -I+k-(1.0-delta)*km

w[3] = -c^(-gamma) + beta*(1+zp*alpha*k^(alpha-1)*lp^(1-alpha)-delta)*cp^(-gamma)

w[4] = c + k - (z*km^(alpha)*l^(1.0-alpha)+(1.0-delta)*km)

w[5] = c^(-gamma)*(1.0-alpha)*km^(alpha)*l^(-alpha)*z-l^(eta)

w[6] = -z+zm*rho

return nothing

end

f = x -> (w = fill(zero(promote_type(eltype(x), Float64)), 6); f!(w, x); return w)

# At the steady-state, the function f should be zero:

Xss = [yss yss yss Iss Iss Iss css css css kss kss kss lss lss lss 1 1 1];

#println(maximum(abs.(f(Xss))))

Jac = ForwardDiff.jacobian(f, Xss);

Collecting matrices A, B and C

Having successfully obtained $\frac{Df}{DY_t}|Y_{SS}$, we now need to collect the right elements to form the matrices A, B and C in order to apply the LTI algorithm. It is mainly a matter of bookkeeping:

# A is derivative of the function "system" f(Vars) w.r.t to Xm = [ym Im cm km lm zm]

# with Vars = [ym y yp Im I Ip cm c cp km k kp lm l lp zm z zp]

A = zeros(6,6)

# Keeping track of indices:

A[:,1] = Jac[:,1]

A[:,2] = Jac[:,4]

A[:,3] = Jac[:,7]

A[:,4] = Jac[:,10]

A[:,5] = Jac[:,13]

A[:,6] = Jac[:,16];

# B is derivative of the function "system" f(Vars) w.r.t to X = [y I c k l z];

# with Vars = [ym y yp Im I Ip cm c cp km k kp lm l lp zm z zp]

B = zeros(6,6)

# Keeping track of indices:

B[:,1] = Jac[:,2]

B[:,2] = Jac[:,5]

B[:,3] = Jac[:,8]

B[:,4] = Jac[:,11]

B[:,5] = Jac[:,14]

B[:,6] = Jac[:,17];

# C is derivative of the function "system" f(Vars) w.r.t to Xp = [yp Ip cp kp lp zp];

# with Vars = [ym y yp Im I Ip cm c cp km k kp lm l lp zm z zp]

C = zeros(6,6)

# Keeping track of indices:

C[:,1] = Jac[:,3]

C[:,2] = Jac[:,6]

C[:,3] = Jac[:,9]

C[:,4] = Jac[:,13]

C[:,5] = Jac[:,15]

C[:,6] = Jac[:,18];

# Convert to log-linear system:

M = ones(6,1)*transpose(XSS)

A = A.*M; B = B.*M; C = C.*M;

Solving the model

We are now in good place to find the law of motion of the economy using the LTI approach.

using LinearAlgebra

# Source: adapted from the matlab version made available by Pontus Rendahl on his website

# https://sites.google.com/site/pontusrendahl/Research

# This function solves the model Ax_{t-1}+Bx_{t}+CE_t[x_{t+1}]+u_t=0, and

# finds the solution x_t=Fx_{t-1}+Qu_t. The parameter mu should be set

# equal to a small number, e.g. mu=1e-6;

function t_iteration(A::Array{Float64,2},

B::Array{Float64,2},

C::Array{Float64,2},

mu::Float64;

tol::Float64=1e-12,

max_iter::Int64 = 1000,

F0::Array{Float64,2} = Array{Float64}(undef, 0, 0),

S0::Array{Float64,2} = Array{Float64}(undef, 0, 0),

verbose::Bool=false)

# success flag:

flag = 0

# Initialization

dim = size(A,2)

if isempty(F0) == true

F = zeros(dim,dim)

else

F = F0

end

if isempty(S0) == true

S = zeros(dim,dim)

else

S = S0

end

eye = zeros(dim,dim)

for i = 1:dim

eye[i,i] = 1.0

end

I = eye*mu

Ch = C

Bh = (B+C*2*I)

Ah = (C*I^2+B*I+A)

#Check the reciprocal condition number

#if rcond(Ah)<1e-16

# disp('Matrix Ah is singular')

#end

metric = 1;

nb_iter = 0

while metric>tol

nb_iter+=1

#\(x, y)

#Left division operator:

#multiplication of y by the inverse of x on the left.

F = -(Bh+Ch*F)\Ah

S = -(Bh+Ah*S)\Ch;

metric1 = maximum(abs.(Ah+Bh*F+Ch*F*F))

metric2 = maximum(abs.(Ah*S*S+Bh*S+Ch))

metric = max(metric1, metric2)

if nb_iter == max_iter

if verbose == true

print("Maximum number of iterations reached. Convergence not reached.")

print("metric = $metric")

end

break

end

end

eig_F = maximum(abs.(eigvals(F)));

eig_S = maximum(abs.(eigvals(S)));

if eig_F>1 || eig_S>1 || mu>1-eig_S

if verbose == true

println("Conditions of Proposition 3 violated")

end

else

flag = 1

end

F = F+I;

Q = -inv(B+C*F);

return F, Q, flag

end

t_iteration (generic function with 1 method)

@time F, Q, flag = t_iteration(A, B, C, 0.01)

0.018310 seconds (11.04 k allocations: 3.390 MiB, 56.25% gc time)

([0.0 0.0 … -1.38108e-18 1.04589; 0.0 0.0 … -8.16878e-18 3.50588; … ; 0.0 0.0 … -1.73472e-18 0.218832; 0.0 0.0 … 0.0 0.9], [0.398069 0.0 … 0.455811 1.1621; -0.0 1.54851 … 1.72393 3.89542; … ; -0.0 -0.0 … 0.683716 0.243147; -0.0 -0.0 … -0.0 1.0], 1)

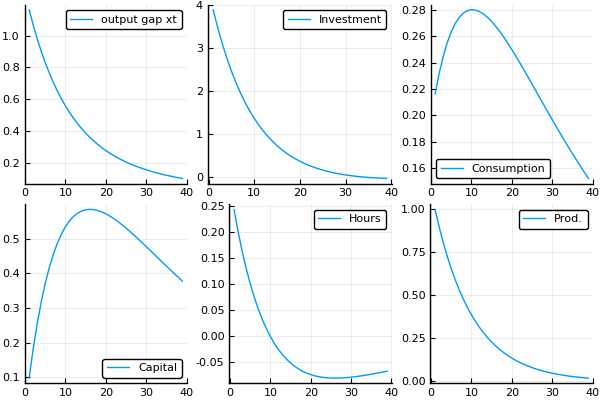

Impulse Response Function

Let’s now simulate the response of the economy to a positive productivity shock. The IRF plots show that this shock leads to a positive response in output, investment, consumption, capital and hours. These variables slowly converge to their steady-state values, as productivity goes back to its steady-state level.

using Plots

pyplot()

nb_periods = 40

x = zeros(6, nb_periods)

u = zeros(6, nb_periods)

#initialization

u[:,1] = [0.0 0.0 0.0 0.0 0.0 1.0]

for t=2:nb_periods

# Law of motion

x[:,t] = F * x[:,t-1] + Q * u[:,t-1]

end

p1 = plot(x[1,2:end], label = "output gap xt")

p2 = plot(x[2,2:end], label = "Investment")

p3 = plot(x[3,2:end], label = "Consumption")

p4 = plot(x[4,2:end], label = "Capital")

p5 = plot(x[5,2:end], label = "Hours")

p6 = plot(x[6,2:end], label = "Prod.")

p = plot(p1,p2, p3, p4, p5, p6)

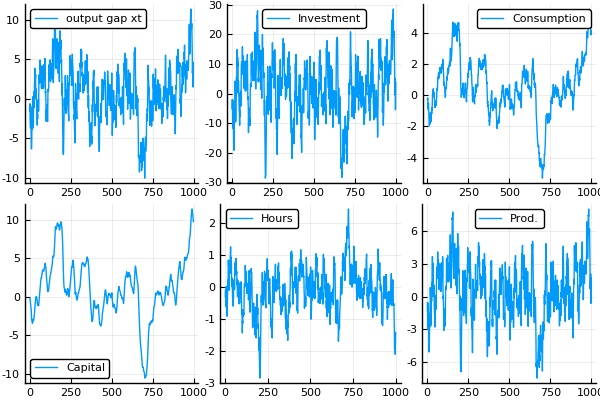

Stochastic Simulation

We can also generate a series of draws from $e_t$ to simulate an economy and calculate moments on the simulated series:

# Calculate a stochastic simulation

using Distributions

d = Normal()

nb_periods = 1000

x = zeros(6, nb_periods)

u = zeros(6, nb_periods)

#initialization

u[6,:] = rand(d, nb_periods) #series of shocks

for t=2:nb_periods

# Law of motion

x[:,t] = F * x[:,t-1] + Q * u[:,t-1]

end

p1 = plot(x[1,2:end], label = "output gap xt")

p2 = plot(x[2,2:end], label = "Investment")

p3 = plot(x[3,2:end], label = "Consumption")

p4 = plot(x[4,2:end], label = "Capital")

p5 = plot(x[5,2:end], label = "Hours")

p6 = plot(x[6,2:end], label = "Prod.")

p = plot(p1,p2, p3, p4, p5, p6)

┌ Info: Precompiling Distributions [31c24e10-a181-5473-b8eb-7969acd0382f]

└ @ Base loading.jl:1192

#correlation matrix

cor(transpose(x[:,2:end]),transpose(x[:,2:end]))

6×6 Array{Float64,2}:

1.0 0.954544 0.842972 0.712213 0.200527 0.979622

0.954544 1.0 0.644305 0.470603 0.483428 0.99496

0.842972 0.644305 1.0 0.978002 -0.357991 0.717745

0.712213 0.470603 0.978002 1.0 -0.544888 0.556709

0.200527 0.483428 -0.357991 -0.544888 1.0 0.393212

0.979622 0.99496 0.717745 0.556709 0.393212 1.0

Conclusion

This post illustrated how one can solve the neoclassical growth model from scratch, using Linear Time Iteration. While the model presented here is quite simple, the three-step approach discussed is quite general.

References

- Rendahl, Pontus. Linear time iteration. No. 330. IHS Economics Series, 2017. (https://www.ihs.ac.at/publications/eco/es-330.pdf)

- The original Matlab code is available here